Investing 101 - A beginner's guide for teens and young adults who want to learn to invest

File Image: IOL

Are you a teen or young adult who dreams of becoming financially independent one day? Managing your finances and starting to think about your financial future may seem premature when you are not yet earning or handling a lot of money, but the truth is that you are never too young to start preparing for your financial future. The biggest hurdle is often not knowing where to start.

Nishlen Govender and Mike van der Westhuizen, both Portfolio Managers at Citadel, have unpacked three key fundamentals to help you get started on your financial journey.

1. KEY CONCEPTS ARE A GOOD PLACE TO START

“Financial jargon seems intimidating, but knowing the basics of certain concepts will help you to better understand your options,” says Govender, offering explanations on the following key elements:

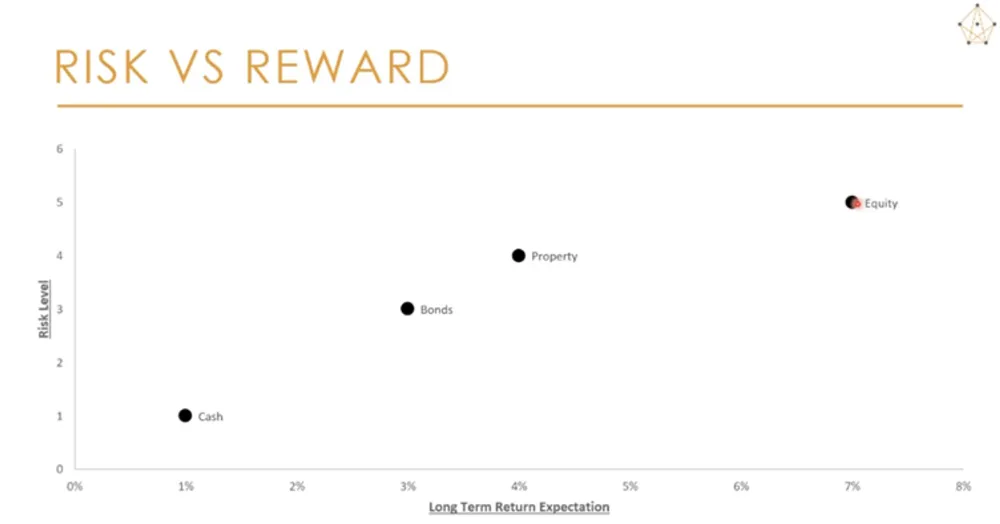

- Equity: When an investor invests in an entrepreneur’s business, he or she may acquire a percentage of that business, for example, they may say, “I’ll give you R1 million in start-up capital for your business in exchange for taking a 30% ownership stake in your business.” That stake is also called “equity”. Equity investing means owning a piece of the company you’ve invested in. This form of investing is considered the riskiest because businesses can fail, but it also gives you the highest potential chance of reward, especially if the business you’ve invested in becomes the next Facebook, Apple or Tesla.

- Debt financing: A company or entrepreneur could use debt (or more simply known as loans) to provide money required to start or fund a business. Investors might say to you, “I’ll give you R1 million in start-up capital for your business, but you need to pay me back with 5% interest within two years as well as the original capital.” That means you need to pay your investors back five hundred thousand rand in that time period. You might have heard of bonds or the bond market – this refers to loan financing. In simple terms a bond is a loan taken out by a company or a government. The key difference between debt and equity financing is that, in debt financing, you receive your loan amount back with some interest (the interest amount is known upfront). In equity financing you own a stake in the business and thus have unlimited upside potential but could lose your capital.

- Cash: It’s essentially the money you put into a bank account. You won’t necessarily lose your money there, so it’s very low on the risk scale, but you’re also not going to make good returns on it – it’s a safe, low return investment for those that want a little bit of upside, but a lot of safety in that investment.

- Property: Whether it be a house, apartment, apartment building, mall or office block, it is a physical asset you can invest in, either by way of debt investing or equity investing. So, even if the company running the property fails, there still is a physical asset you can sell to recoup all or some of your investment. That makes it slightly lower risk than equity investing, although the property market can be quite volatile.

In the below graph you can see that “equity investing” sits right at the top of the risk and reward scale, while “cash investing” presents the lowest potential risk and the lowest potential reward.

2. WHAT IS THE RULE OF 72?

“Our objective should always be to make the highest returns at the lowest risk. The rule of 72 is a handy concept to understand how much return on investment (ROI) you require to meet your goals,” says Govender.

The idea is that you take the number 72 and divide it by the return you expect, which will provide a good idea of how long it will take you to double your money. For instance, if you find an investment that gives you a 12% ROI every single year, it will take you six years to double your money – because 72 divided by 12% gives you six. If your bank offers you a 2% annual return on your money, it will take you 36 years to double your

3. THE IMPORTANCE OF INVESTING AS EARLY AS POSSIBLE WITH THE RIGHT GUIDANCE

Van der Westhuizen explains that when you are a teen or young adult, it can be easier to invest in opportunities that offer higher risks, but also higher rewards. “Once you have a family, you will likely need to spend most of your money on family financial responsibilities – and in your retirement years you might need to prioritise your medical bills, so you probably won’t really be looking to invest in the next big high risk, high reward opportunity,” he says.

There are many perks to starting your investment journey as early as possible and speaking to a registered financial advisor is always encouraged – they will get to know you, your current financial needs as well as your financial goals for the future and use this to create a financial roadmap tailored specifically to you.

Some things your financial advisor should consider, given your young age:

Investing in equities for the long term

Shares or equities are the most volatile in terms of seeing your invested money fluctuating over time, but you are assured of excellent returns over the long term. If you invest in the stock market you might see your money going up and down every day, so in the short term it is very risky, but if you stick to it for 20 or 30 years your risk will even out, and you will see good growth. If for instance, you invested in the S&P 500, the American stock market, anytime between 1926 and 2015, for just one year and took your money out, you had a 74% chance of making positive returns, but if you were invested there for 20 years, you had a 100% chance of seeing a positive ROI.

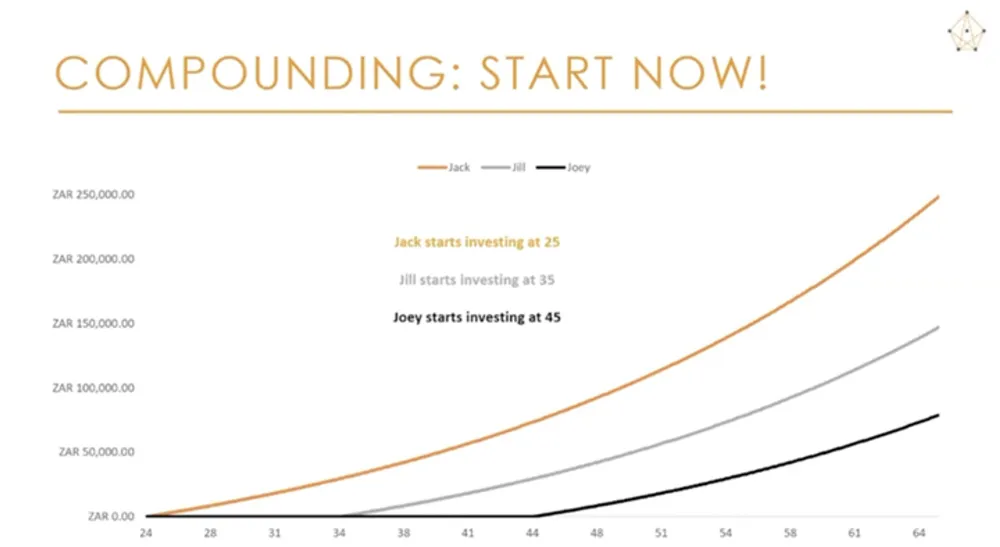

Compound interest

If you start investing R200 a month when you are 25 and you stopped at 35, you would make better returns over your lifetime than someone who started with R200 a month at age 35 and carried on paying for the rest of his or her life (assuming the same investment returns). It comes down to the concept of compound returns – money makes money. The value of your investment grows, then you get more growth on your growth, and eventually you see exponential growth. The same goes for retirement investing. Start in your 20s – otherwise you might not have enough. The graph below illustrates the power of compounding in building wealth.

Defining your goals and setting a budget

Decide how much you are willing and able to invest per year. Look at your income whether it be pocket money or earnings from a job, and divide your expenses into fixed expenses (e.g. food and shelter) versus variable expenses (e.g. fun stuff). Try to keep both these expenses as low as possible so that you have something left over for investing.

Deciding where to invest

You can either do this by yourself, or seek professional assistance. Whatever you invest in, always try to increase your investments by a small margin every year, for instance by 5%. This will be very beneficial to you in terms of the effects of compounding.

“No one expects you to know everything about the financial world when you start looking into your investment options for the first time – the important thing is that you have the foresight to see the importance of starting early and that you are open to discussing your options,” says Van der Westhuizen. Govender agrees: “The hardest part is recognising that it may be best to do something better with a portion of your money rather than just spending it – the rest can be easy, under the help and guidance of a trusted professional.

PERSONAL FINANCE